nebraska sales tax rate finder

In 2003 Nebraska amended its sales and use tax laws to conform with the Streamlined Sales and Use Tax Agreement. This is the total of state county and city sales tax rates.

So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate of your buyers ship-to location.

. Nebraska has a state sales and use tax rate of 55. Nebraska sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. The one with the highest sales tax rate is 68310 and the one with the lowest sales tax rate is 68001.

Nebraska Sales Tax Map Legend. The Nebraska sales tax rate is currently. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 605 in Nebraska.

The Nebraska state sales and use tax rate is 55 055. The Department of Revenue announces that effective October 1 2019 the Sales Tax Rate Finder will be provided through a partnership with the Nebraska Geographic Information Office GIO. Did South Dakota v.

The Nemaha sales tax rate is. From the Nebraska Department of Revenue Daily Digest Bulletin. Taxes in Nebraska Nebraska Tax Rates Collections and Burdens.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. However local jurisdictions are also able to impose additional sales taxes of 05 1 15 175 or 2.

This can make your local sales taxes as high as 75. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts. The minimum combined 2022 sales tax rate for Nemaha Nebraska is.

What is the sales tax rate in Nemaha Nebraska. Taxes in Nebraska are destination-based meaning the Alabama sales tax rate is determined from the shipping address. As of 2019 the Nebraska state sales tax rate is 55.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Its important to note that some items are exempt from sales tax in Nebraska including prepared food and related ingredients. All numbers are rounded in the normal fashion.

Nebraska has a 550 percent state sales tax rate a max local sales tax rate of 250 percent. The County sales tax rate is. Find your Nebraska combined state and local tax rate.

Nebraska has a graduated individual income tax with rates ranging from 246 percent to 684 percent. If local tax applies enter your local code and multiply your total taxable purchases by the local rate 005 010 015 0175 or 02. The Nebraska State Sales Tax is collected by the merchant on all qualifying sales made within.

Also effective October 1 2022 the following cities. Sales Tax Rate s c l sr. Please select a specific location in Nebraska from the list below for specific Nebraska Sales Tax Rates for each location in 2022 or calculate.

The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. Click on any county for detailed sales tax rates or see a full list of. This complicates business for retailers who need to have the exact and up-to-date.

The new Sales Tax Rate Finder will be based on GIS mapping and will provide the correct state. Nebraska also has a 558 percent to 750 percent corporate income tax rate. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions.

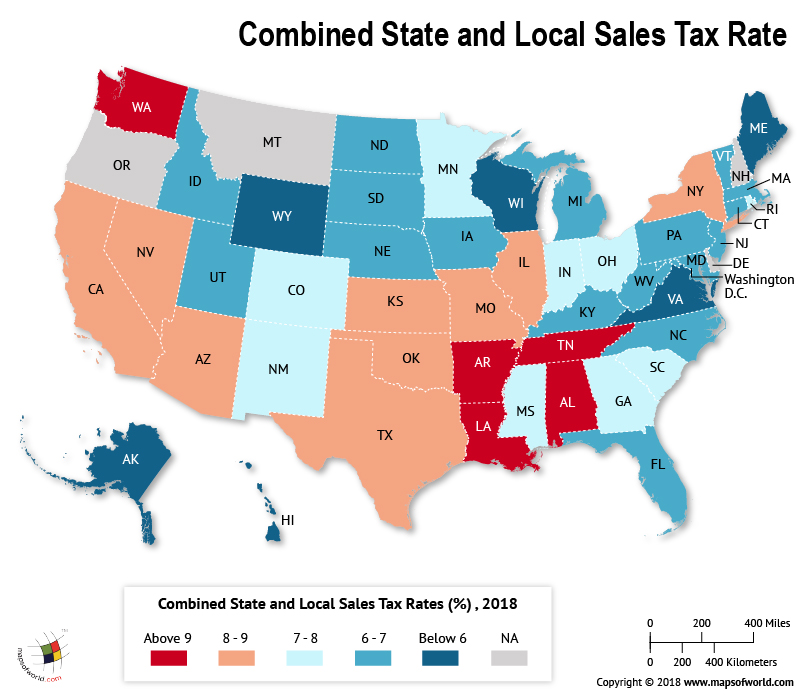

Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. FUN FACTS Nebraska saw the largest decrease in sales taxes in 2019 the state ranks 27th for its combined state and local sales tax. The Nebraska sales tax rate is currently.

This is the total of state county and city sales tax rates. Lowest sales tax 45 Highest sales tax 8 This interactive sales tax map map of Nebraska shows how local sales tax rates vary across Nebraskas 93 counties. Average Sales Tax Including Local Taxes.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Nebraska sales tax rate finder. Nebraska is a destination-based sales tax state.

Add the state and local tax amounts together and enter on line 42 of the tax return. You can look up your local sales tax rate with TaxJars Sales. Did South Dakota v.

The County sales tax rate is. While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

31 rows The state sales tax rate in Nebraska is 5500. The Nebraska sales tax rate is currently 55. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15.

So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the municipality. This is the total of state county and city sales tax rates. Wayfair Inc affect Nebraska.

How does Nebraskas tax code compare. With local taxes the. Nebraska sales tax details.

ArcGIS Web Application - Nebraska. The Nebraska NE state sales tax rate is currently 55. In Nebraska each county city and special district can add sales taxes on top of the state rate.

The use tax information appears on line 42 of the Nebraska Form 1040N. Multiply this amount by 55 055. The base state sales tax rate in Nebraska is 55.

Sales Taxes In The United States Wikiwand

New Jersey Nj Tax Rate H R Block

State Corporate Income Tax Rates And Brackets Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Tax By State Is Saas Taxable Taxjar

What Is Sales Tax A Complete Guide Taxjar

States With Highest And Lowest Sales Tax Rates

/images/2022/01/18/couples-tax-rate-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

Nebraska Sales Tax Small Business Guide Truic

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)